What do Employers need to know about managing staff during the the Coronavirus Pandemic?

(updated 4th January 2023)

Acas has regularly updated advice for Employers on how to deal with the new Coronavirus (COVID-19) outbreak. Below are the details of all the significant/current announcements from the UK Government since 11th March 2020, including advice relating to the changes coming on 19th July 2021.

You can read the Acas advice on Coronavirus here.

Acas have also issued guidance on how to run disciplinary hearings during the Coronavirus pandemic period which you can see here.

If you need help with your staffing issues and the options that employers have during the pandemic, you can contact The HR Kiosk here (but please note we are exceptionally busy at the moment).

On 18th May the major Broadcasters in the UK agreed guidelines that Producers can follow to allow television programmes to start filming again. On 1st June further guidelines were agreed for for high-end TV drama and film – you can see all the details here. The joint industry guidance for TV Production was updated on Wednesday 9th December 2020 – you can see details here.

This letter is an example of what Employers should NOT do if they need to reduce staff!:

Government updates:

-

SSP changes

The following information is from the Budget on 11th March 2020 (the Budget document is here):

Eligibility for Statutory Sick Pay (SSP) – SSP to be paid from the first day of sickness absence, rather than the fourth day, for people who have COVID-19 or have to self-isolate, in accordance with government guidelines. This ends on 24th March 2022, when it reverts to pre-Covid conditions.

The Budget sets out a further package to widen the scope of SSP and make it more accessible. The government will temporarily extend SSP to cover:

- individuals who are unable to work (and cannot work from home) because they have been advised to self-isolate by NHS Test and Trace or a local authority tracing team – but not those who have been pinged by the NHS Covid App – (from August 2020 this includes those who are asked to self-isolate in advance of surgery or another hospital procedure)

- people caring for those within the same household who display COVID-19 symptoms and have been told to self-isolate.

Medical Evidence for SSP – This Budget announced a temporary alternative to the fit note which can be used for the duration of the COVID-19 outbreak. This will enable people who are advised to self-isolate to obtain a notification via NHS111 which they can use as evidence for absence from work, where necessary. The notification is available here.

Support for businesses – Statutory Sick Pay – The government will support small and medium-sized businesses and employers to cope with the extra costs of paying COVID-19 related SSP by refunding eligible SSP costs. The eligibility criteria for the scheme are as follows:

- this refund will be limited to two weeks per employee (the guidance says this is available to anyone on PAYE – so employees who are permanent and on Fixed-Term Contracts; casual and zero-hours contracted staff and agency workers).

- employers with fewer than 250 employees will be eligible. The size of an employer will be determined by the number of people they employed as of 28 February 2020

- employers will be able to reclaim expenditure for any employee who has claimed SSP (according to the new eligibility criteria) as a result of COVID-19

- employers should maintain records of staff absences, but should not require employees to provide a GP fit note

- This will apply retrospectively from 13th March 2020 (or from 16th April for those who were off sick because they were shielding). During the budget of 3rd March 2021 this support was extended, and it has just been announced that the scheme will end on 30th September 2021.

- Government guidance is here.

- You can claim back SSP here

The SSP rebate scheme has been re-instated from 21st December 2021 – you can read more details here. This now closes on 17th march 2022.

From 17th December 2021 to 26th January 2022, the Government have changed the rules on SSP certification – workers can now self-certify absences for up to 28 days (normally only for 7 days) – you can read the full details here.

2. On 17th March 2020 the Government published its Coronavirus legislation which you can see here.

3. Support for businesses through the Coronavirus Job Retention Scheme (furlough)

Under the Coronavirus Job Retention Scheme, all UK employers will be able to access support to continue paying part of their employees’ salary for those employees that would otherwise have been laid off during this crisis.

Eligibility

All UK businesses are eligible. The original scheme was for those employees who were on the employer’s PAYE payroll as of 19 March 2020 (changed from 28th February).

On 29th May the Chancellor announced that the scheme would be extended to October 2020, with employees being able to go back to work part-time from 1st July.

There is some interesting information about Carluccio’s restaurant group going into administration, and the administrators using the Furlough scheme here and here.

The HMRC can also take criminal action in cases of fraudaulent use of the scheme by Employers. They are encouraging employees to tell them if they believe their employer is defrauding the HMRC under the furlough scheme via its online portal.

Although the Scheme was due to close on 31st October, the Government announced on the 31st October that it would be extended until December – initial details are here. On 5th November, the Government announced that the Scheme would be extended to 31st March 2021. Details are here and here. The policy paper is here. Further Guidance was published on 10th November which you can see here.

On 17th December the Chancellor announced that the scheme would be further extended to 30th April 2021. On 3rd March 2021 at the Budget it was announced that the scheme would be extend until 30th September 2021. The latest Government guidance is here, and the latest Treasury Guidance, published in April 2021 is here.

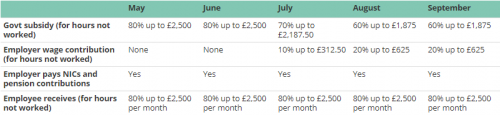

Employees will continue to receive 80% of their current salary for hours not worked. Employers will continue to have to pay NIC and pension contributions until 30th June 2021 and the Government will continue to pay 80% of hours not worked (capped at £2,500). From July, employers will need to contribute 10% to the cost of un-worked hours, and the government will pay 70% of usual wages for hours not worked up to a cap of £2,187.50, During August and September, employers will need to contribute 20% to the cost of un-worked hours, and the government will pay 60% of usual wages for hours not worked up to £1,875. More details, published on 3rd March 2021, are here.

And here is a nice graphic!

To access the extended scheme (to September 2021), neither the employer nor the employee needs to have previously used the scheme. The guidance confirms that employers are able to furlough employees who are unable to work because they are clinically extremely vulnerable, or at the highest risk of severe illness from coronavirus and following public health guidance, or who are unable to work because they have caring responsibilities resulting from COVID-19, including employees that need to look after children who are at home as a result of school and childcare facilities closing, or who are caring for a vulnerable individual in their household.

It is important that Employers are aware they will not be able to claim for employees who are under contractual or statutory notice for claim periods on or after 1 December 2020. This includes any employees being made redundant and also those employees who resign.

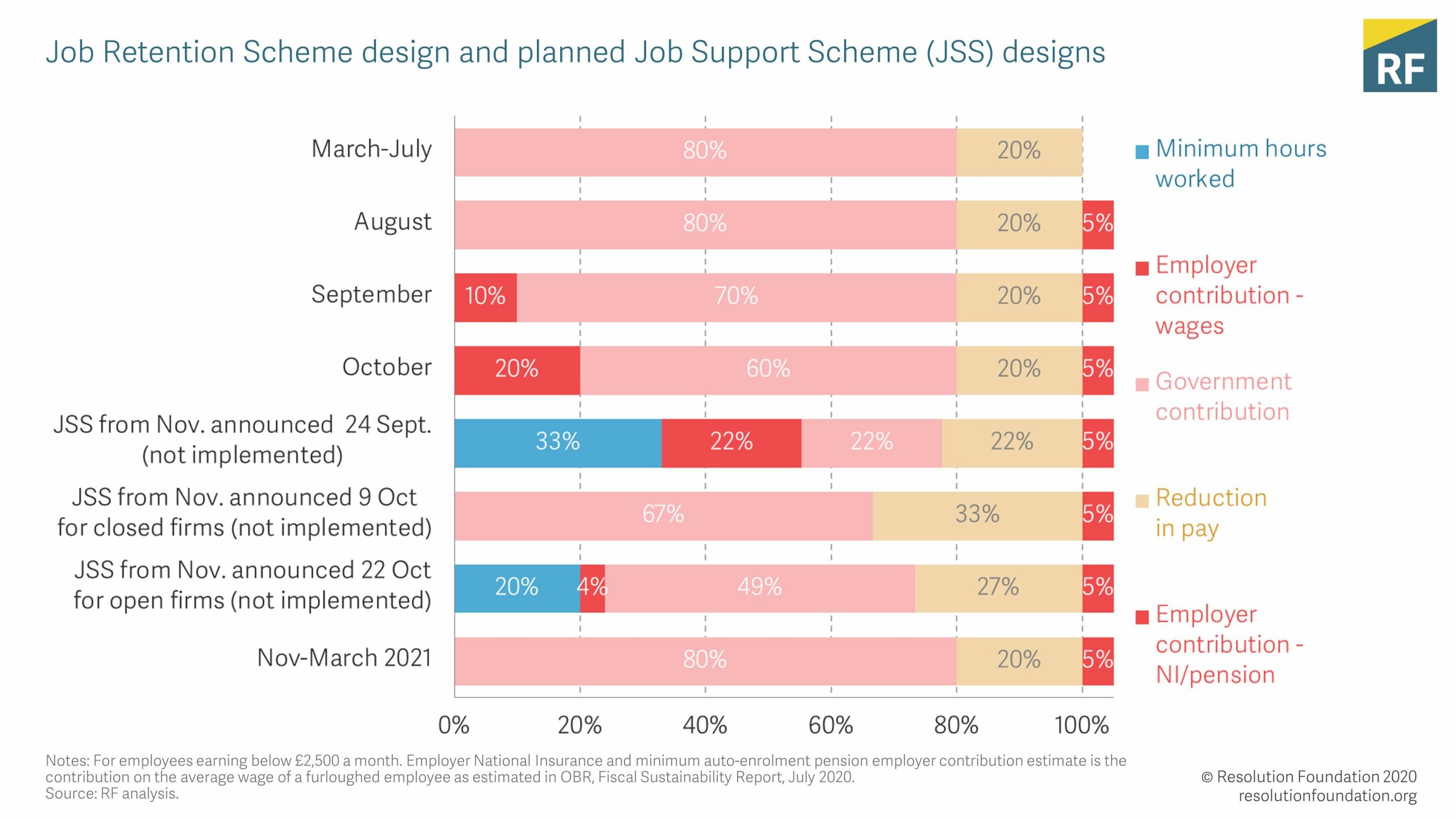

Here is a nice graphic of all the first few iterations of the Job Support Schemes –

4. The Chancellor’s announcement on Thursday 26th March about the new Coronavirus Self-Employment Income Support Scheme – details are here. And further details are here. The scheme has been extended until 2021 and amounts have changed several times, you can see the latest details here.

The Government announced on 2nd November that SEISS would be an average of 55% of trading profits over the period from November to January, with a maximum grant available of £5,160 (using 80% for the month of November and 40% for the other 2 months). Applications can be made at the end of November, rather than as previously announced in the middle of December. On 5th November the Government announced that SEISS would be 80% of trading profits for the period November-January, up to £7,000.

On 3rd March 2021, at the Budget, it was announced there would be a fourth grant of 80% of 3 months average trading profits, to cover the period February to April 2021. This can be claimed from late April, more details to follow. All those self-employed individuals who filed a 2019/2020 tax return (by 2nd March 2021) can claim this grant.

A fifth grant was also announced, covering the period May to September. There will be a turnover test so the grant is targeted at those who need it most, and the grant can be claimed from late July. More details here!

On 24th November 2021, the Court of Appeal found that tens of thousands of self-employed women who took maternity leave were indirectly discriminated against by the UK government during the pandemic, as their SEISS claims were calculated including the periods of their maternity leave when they were paid less. However these women will be unable to claim rebates, the Court has ruled. You can read more details here.

5. The Government announced, on 27th March 2020, that workers who have not taken all of their statutory annual leave entitlement in 2020, due to the Coronavirus pandemic, will now be able to carry it over into the next 2 leave years. More details here. Government guidance is here.

6. The Government announced on 30th March 2020 that there would be changes to Right to Work in the UK checks, during the Coronavirus pandemic. You can read the details here. This will now end on 30th September 2022 and in-person checks will need to re-start from 1st October 2022. However, in early January 2022 the Government announced that digital right-to-work checks are to be made permanent on 6th April 2022.

7. The Government published a Sector by Sector Guide to Social distancing in the workplace during coronavirus on 7th April 2020, which you can read here.

The requirement for businesses to explicitly consider Covid in their Health and Safety risk assessments will end on 24th February 2022.

8. Coronavirus Test and Trace System launched on 28th May 2020 (in England and Scotland – operating in Northern Ireland since 27th April and Wales from 1st June)

The UK’s test and trace strategy means that anyone testing positive for the virus will be contacted by text, email or phone and asked to log on to the NHS test and trace website to provide their details, along with those of who they live with, places they’ve visited recently, and the names and contact details of people they have been in close contact with in the 48 hours before symptoms started, so that NHS contact tracers can track them down.

Under the scheme, those who have come into close contact with someone who tests positive will receive a phone call, text message or email telling them to stay at home for two weeks, even if they have no symptoms. In this situation staff would be entitled to their normal sick pay.

On 27 May 2020, further new regulations extended SSP to those who are self-isolating for 14 days after being notified that they should do so by the NHS test and trace service. This covers people who are not unwell but have been told to self-isolate because they have been in close contact with someone who has tested positive for Covid-19. SSP is payable from the 1st day in these circumstances and can be reclaimed by the Employer. SSP only applies to those who cannot work because of self-isolation, so people who can continue to work from home will not be entitled to SSP; if the employee is able to work remotely, they will be entitled to usual pay.

The Government have produced guidance for employers about the test and trace programme which you can see here.

The Government announced that from Monday 14th December, across the UK, the 14-day isolation period would be cut to 10 days for those required to self-isolate after being in contact with someone who has coronavirus and for those returning to the UK from a country not on the travel corridor list. This 10 day period already applies to people who have suspected coronavirus symptoms or have a positive test.

From 16th August 2021 people who are fully vaccinated will no longer have to self-isolate if they are contacted by NHS Test and Trace if they have had their 2nd jab at least 10 days before (if they are ‘pinged’ by the NHS Covid App? It is not yet clear). People will need to still self-isolate if they test positive. Employees have a legal obligation to tell their employer if NHS Test and Trace informs them to self-isolate if they are not fully vaccinated. Employees do not have a legal obligation to tell their employer if they are ‘pinged’ by the NHS Covid19 App.

The latest Government advice, which came into effect on 24th February 2022 is here. All restrictions have been lifted in England and the legal requirement to self-isolate ends; people are advised to stay at home and isolate if they have Covid or believe they do, but there are no legal requirements to do so. People are advised to take a lateral flow test on the 5th and 6th day and if both are negative and they have no temperature, they can resume normal life. Contact tracing will also end. And free testing for the public will end in England from 1st April 2022 (with some exceptions). Workers will also no longer be under a legal duty to inform their employer if they are required to self-isolate.

9. Government advice on Workplace Testing

Published on 10th September, which you can see here.

On 7th February 2021 the Government announced a scheme to increase workplace testing in sectors open during lockdown, to detect coronavirus (COVID-19) in people who are not showing symptoms. Employers can register here before 31 March 2021, to order free rapid lateral flow tests for your employees if:

- the business is registered in England

- you employ 50 people or more

- your employees cannot work from home.

From 6th March the free tests are available to businesses with less than 50 people, as long as they register by the end of March.

Further guidance on workplace testing has been published and guidance on working safely during coronavirus has been updated to reflect the extension of rapid workplace testing to businesses with 50 or more employees.

(10. The Chancellors announcement on 24th September 2020 about the Job Support Scheme Open and later about the Job Support Scheme Expansion for Closed Business Premises. These schemes are now postponed.

Initial information is here)

(11. Changes to the new Job Support Scheme on 22nd October 2020

Initial details are here. The Policy Paper is here. Guidance was published on the evening of 30th October and is here.

However, the new Job Support Scheme has now been postponed while the furlough scheme is extended! )

12. Changes to employment tribunals and early conciliation procedures

In September 2020, the Government announced that in order to boost capacity in the tribunal system (because of the Coronavirus pandemic), the standard period for pre-claim conciliation by Acas, between the employer and employee, would be extended to 6 weeks for all cases, from 1st December 2020 (rather than the standard 1 month with the possibility to extend it by 2 weeks). You can read more details here.

13. Advice for the Clinically Vulnerable

The Government introduced new advice for those who are ‘clinically vulnerable’ (and were probably ‘shielding’ before August 2020) on 13th October – which you can read here

From 1st April 2021 ‘shielding’ will come to an end in England and Wales (it looks like shielding in Scotland will end on 26th April). However, people who have been shielding are advised to continue to take extra precautions to keep themselves safe, such as social distancing and working at home where possible. SSP entitlements for shielding will end on 1st April.

Advice for the Clinically Vulnerable in England from 19th July 2021 is here. From this date they are no longer advised to shield, but should be supported by their Employers if they need any additional precautions.

14. International travel and hotel quarantine plans

You can read details of ‘Test to Release’ here, which came into effecton 15th December 2020.

On 18th January 2021 the Travel Corridors scheme closed. Arrivals to the UK from now must take a negative coronavirus test up to 72 hours before departure to the UK; and must self-isolate for up to 10 days on return to the UK (or take a private test after 5 days under the Test to Release scheme). There were exemptions to the travel restrictions for ‘high-end’ business travellers, performing arts professionals, journalists, television production and film workers, but these have now been removed. Now, exemptions to travel restrictions only remain for aircraft crew, hauliers, offshore oil and gas workers and people involved in elite sport, medical and others professions which are detailed here.

From 15 February 2021 onwards, everyone allowed to enter England who has visited or passed through a country where travel to the UK is banned /on the red list must:

- quarantine for 10 days in a managed quarantine hotel

- take a coronavirus (COVID-19) test on or before day 2 and on or after day 8 of quarantining

- follow the national lockdown rules

You cannot travel to England if you’ve visited or passed through a country where travel is banned in the last 10 days, unless you’re:

- a British national

- an Irish national

- anyone with residence rights in the UK.

More information is here. The traffic light system continues after the 19th July and will be reviewed every 3 weeks throughout the summer. Quarantine requirements for fully vaccinated UK travellers returning from amber countries will be removed.

December 2021 – the latest positions on quarantine and travel are here.

15. Advice for pregnant employees – updated 11th January 2021 – which you can see here.

16. Vaccines

At the end of February 2021, Acas advised employers to give their staff paid time off to attend Covid-19 vaccination appointments and also to allow staff time off sick if they have any side effects after having the vaccine.

The Information Commissioner’s Office (ICO) has recently published guidance on the data protection privacy issues that employers need to consider in relation to recording their employee’s vaccination status. The guidance covers issues such as “Can I collect data about whether my employees are vaccinated against COVID-19?” and “What lawful basis should I use to record my employees’ vaccination status?”

On 14 April 2021 the Government launched a 5-week consultation on whether vaccines for care home workers should be mandatory. They decided it should and so this will become a legal requirement from 11th November 2021. The Regulations make it mandatory for a person working or providing professional services in a care home in England to have the Covid-19 vaccine unless the person has provided clinical reasons why he or she cannot be vaccinated. These rules are to be scrapped on 15th March 2022.

The Government have also announced that anyone who works in health and social care settings (regulated by the Care Quality Commission) will have to be fully vaccinated against covid-19 by 1 April 2022. This rule is to be scrapped on 15th March 2022.

17. Coronavirus employment law cases are slowly trickling in!

- A Lorry driver who was sacked for refusing to wear face mask was not unfairly dismissed. Details of this February 2021 landmark case are here.

- In Rodgers v Leeds Laser Cutting Limited (in March 2021) an Employment Tribunal found that an employee could not rely on health and safety reasons in an automatic (Health & Safety) unfair dismissal claim “to refuse to work in any circumstances simply by virtue of the pandemic” Further details are here and here. This case was appealed to the EAT, who in May 2022 agreed with the original ET decision. The case was further heard at the Court of Appeal (December 2022) who agreed with the EAT and Rodgers lost his unfair dismissal claim.

- In March 2021 a Tribunal found that a Solicitor had been unfairly dismissed in Khatun v Winn. In March 2020, Winn Solicitors Ltd decided to make changes in response to the pandemic and asked staff not already furloughed to agree to a variation of their employment contract, which required them to go on furlough leave or have their hours and pay reduced. If they refused they would face dismissal. Ms Khatun could not agree to the variation and was dismissed without any process being followed. The Tribunal agreed with Winn that their reasons for implementing the contract variation were ‘sound, good business reasons’, however the dismissal of Ms Khatun was not a decision that fell within the ‘band of reasonable responses’.

- In Accattatis v Fortuna Group London Ltd (heard in April 2021) Mr Accattatis did not persuade a tribunal that his concerns for his safety at work made his dismissal automatically unfair. Fortuna made PPE and so staff were considered ‘key workers’ and the business remained open through the first lockdown, and his job included accepting daily deliveries of equipment. Mr Accattatis developed COVID symptoms and self-isolated but continued to feel unwell after this period. He then asked to be furloughed but his employer refused as he was needed at work. He asked to be furloughed 2 more times and his employment was terminated. Mr Accattatis did not quite have 2 years service so could not claim unfair dismissal (which he would likely have won because of the lack of procedure by the Company, at least!) so therefore bought a claim under Health and Safety laws in the Employment Relations Act 1996 section 100 – that his workplace posed a serious and imminent danger to him. The tribunal felt that there was danger at the workplace but Mr Accatatis had not taken appropriate steps to protect himself from danger or explore ways in which the danger might be mitigated – his demands for furlough and working from home (he couldn’t do his job from home) were not appropriate steps to protect him from danger at work.

- In June 2021, in Gibson v Lothian Leisure, Mr Gibson was a chef whose father was shielding during the first lockdown in 2020. Mr Gibson was initially put on furlough but then asked to return to work near the end of the first lockdown. Mr Gibson told Lothian he was worried about his father catching COVID if he returned to work. He raised concerns that the restaurant had no PPE and had no intention of creating a secure working environment. The employer told him to “shut up and get on with it” and then dismissed him by text. As Mr Gibson did not have enough service to bring an unfair dismissal claim, he bought a claim for automatic unfair dismissal under Section 100 of ERA (as above) and the Tribunal agreed with him – he reasonably believed that danger was serious and imminent.

- In July 2021 an Employment Tribunal found that a Contractor, Mr D Perkins, (working at Clients through a Recruitment Agency) did NOT accrue holiday pay while on furlough in 2020. His Employer Best Connection Group Limited had argued that when he was on furlough he was not working on an assignment and therefore could not be a worker for the purposes of accruing annual leave (under the Working Time Regulations0. Mr Perkins was engaged on a Contract for Services, and the Contract only existed when the claimant was on an assignment with the client.

- In December 2021 in an case where neither the employee or employer were named (so called X v Y), a Manchester Employment Tribunal found that a fear of catching Covid was NOT a protected belief under the Equality Act. The female employee said she was discriminated against by her employer because she refused to go to work in July 2020 and wasn’t paid; she said she had a ‘genuine fear’ of getting coronavirus and giving it to her partner, who was at high risk. The Judge accepted she had a genuine fear but this was not a criteria for a “philosophical belief” that would be protected under the Equality Act 2010.

- In December 2021, in Preen v Coolink v Mullins, an Employment Tribunal had to decide if an employee was unfairly dismissed for raising safety concerns, just after the first national lockdown of 23rd March 2020. Mr Preen was an engineer working for a small company who provided emergency cover and servicing to customers, which included hospitals and the food industry. On 23rd March people were told they could only travel to and from work if it was ‘absolutely necessary’ and they could not work at home. That evening, Mr Preen contacted his manager, Mullins, to ask how the lockdown affected his work. Mullins said they continue to go to work but could not gather socially. Preen was not happy with this and told Mullins “…I am going to stay at home and would urge you to do the same. I understand that if any call out is urgent and/or essential I will come in to help out of course…”. Mullins replied “no issues” but a few days later dismissed Mullins for ‘redundancy’ because he had refused to come to work. Preen argued to the Tribunal that he had been unfairly dismissed for raising health and safety issues under Section 100 (as above); he didn’t have 2 years service to claim unfair dismissal in the normal way. The tribunal found that Preen’s message had alerted his employer to his concerns about working during the lockdown, but they then considered whether his dismissal was also unfair under section 100(1)(d), where to succeed, Preen had to demonstrate that he had refused to come into work because of a serious and imminent danger. The Tribunal found Preen failed this threshold – they did not think he reasonably believed that he (or others) were in serious and imminent danger if they went to work; the Company had taken sensible precautions – masks, hand sanitiser and a COVID Health and Safety procedure – and Preen had said he was willing to do emergency work which undermined his claim that this workplace was dangerous.

18. Budget announcement to support Jobs, 3rd March 2021

The announcement included:

- the Government will provide £1.26 million in England for high quality work placements and training for 16-24 years olds. Employers who provide trainees with work experience will be paid £1,000 per trainee.

- Employers who hire an apprentice between 1st April and 30th September 2021 will receive £3,000 per new hire.

19. Legal requirement to work from home ends in England on 19th July 2021

From this date, the Government is no longer instructing people to work from home, but recommends there is a gradual return to the work place, over the summer.

On 19th July most legal restrictions around Covid will end and all businesses will be able to open without capacity limits. Guidance for business is here and specifically for Offices here. Employers should follow the principles set out in the ‘working safely’ guidance, which include conducting a health and safety risk assessment, providing adequate ventilation and cleaning. It will remain an offence for an Employer to allow a worker who should be self-isolating to come into work.

The requirement to wear face masks will be lifted on 19th July and the Government recommends that face coverings are worn in crowded, enclosed, areas such as public transport.

Employers should discuss with staff their attitude to wearing masks and social distancing measure in the workplace. Employers have a first duty to protect the Health and Safety of their employees, but it may be difficult to impose mask wearing unless there are circumstances which make this absolutely necessary, i.e. the need to work in a crowded, enclosed space. Ideally there should be a consensus between the employer and their employees.

Acas have published a guide to Hybrid-working and how Employers should prepare for it, which you can see here.

The Government announced on 8th December 2021 that people in England should work from home if they can from 13 December. This will end on 27th January 2022.

20. Long Covid

The ONS estimate that over 1 million people have reported experiencing long COVID symptoms. Acas has published a guide to help Employers handle the associated sickness absence and return to work. The guide acknowledges that it is hard to say yet whether long COVID will be a disability, but recommends making ‘reasonable adjustments’ to help workers who are suffering from it.

21. Tax Relief for working at home

Details here in an article from Brodies LLP.

Other Coronavirus information:

- All Government advice is here

- In September 2020 Acas published a ‘return to the workplace’ process map which you can see here.

- NHS advice is here

- NHS111 Online is here

- The Health and Safety Executive have updated guidance for Employers during the pandemic which you can see here. There are also updated RIDDOR requirements for COVID 19 which you can see here.

- The Government’s guidance on infection control and PPE can be seen here.

You can download the NHS Hand washing techniques here

You can read the Government’s guidance for households with possible coronavirus infection here.

If you need help with your Coronavirus staffing issues and the options that employers have during the pandemic, you can contact The HR Kiosk here (but please note we are exceptionally busy at the moment).

The Film and TV Charity offer financial support in cases of hardship for those who have worked in the industry for 2 years, and may have found their contracts being cancelled or suspended.

You can see the recent TV and Film Guidelines to re-start programme making here.